Are you interested in investing in real estate, but want to take a unique approach by focusing on historic properties? Look no further! This article will provide you with valuable tips and insights on how to successfully invest in historic real estate. From the importance of thorough research to understanding the benefits of owning a piece of history, you will learn everything you need to know to make informed investment decisions in this niche market. So, grab your notebook and get ready to embark on an exciting journey into the world of historic property investing!

So, you’re interested in investing in historic properties?

Investing in real estate can be a rewarding venture, especially when focusing on historic properties. Whether you are a seasoned investor or new to the real estate market, there are some important factors to consider when looking to invest in historic properties. In this article, we will explore how you can start investing in real estate with a focus on historic properties, and some key things to keep in mind throughout the process.

Let’s get started by understanding what historic properties are.

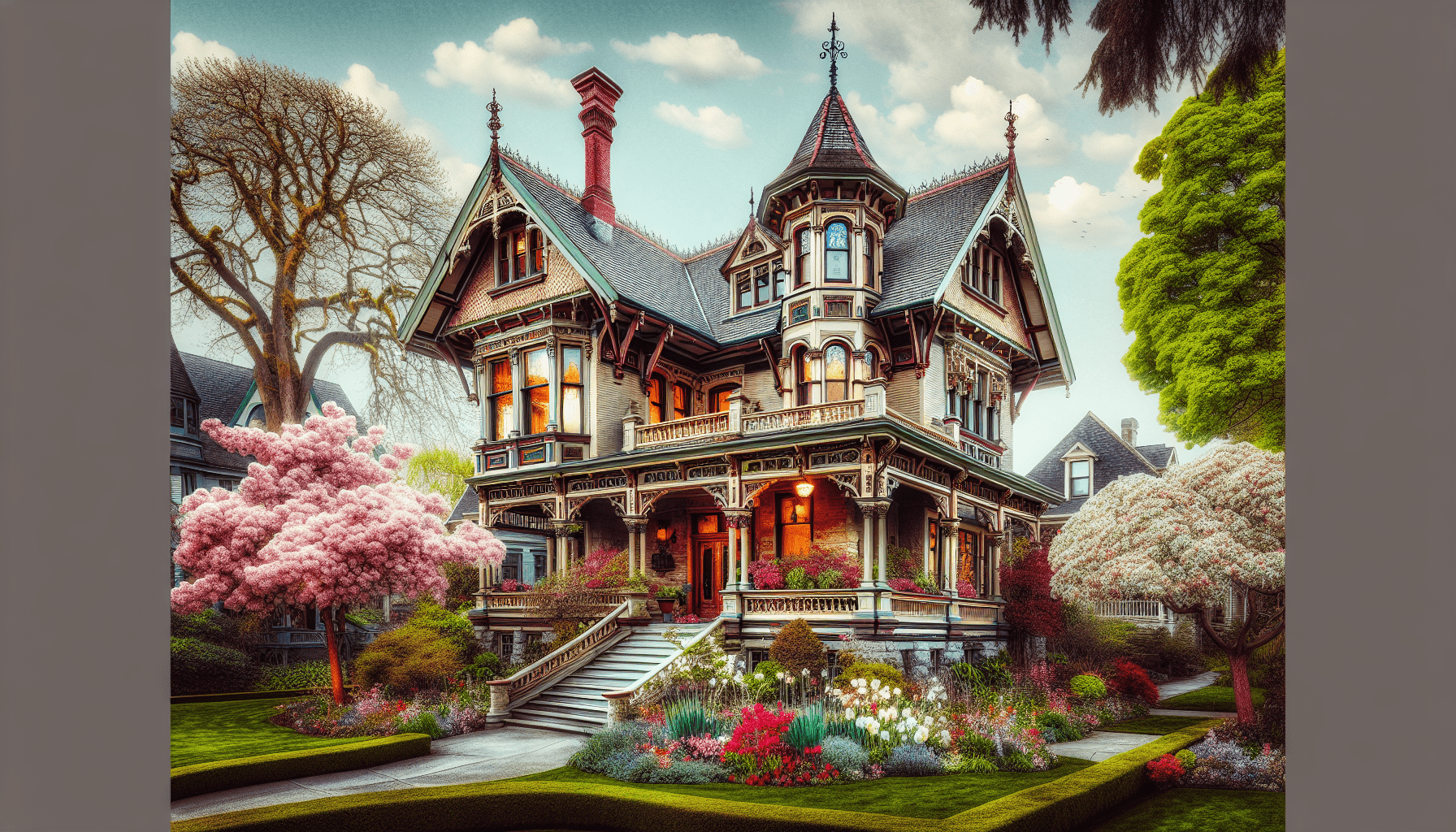

Historic properties are buildings, structures, or sites that have historical significance and are typically recognized for their architectural, cultural, or social value. These properties are often protected by local, state, or national regulations to preserve their historical integrity. Investing in historic properties can be a unique opportunity to own a piece of history and contribute to the preservation of our heritage.

Types of historic properties to consider investing in.

When it comes to investing in historic properties, there are several types to consider. Some common types of historic properties include:

-

Historic homes: These are residential properties that have historical significance, such as former homes of notable figures or properties from a specific architectural period.

-

Commercial buildings: Historic commercial buildings, such as former factories, warehouses, or storefronts, can provide unique investment opportunities for those looking to revitalize historic downtown areas.

-

Historic landmarks: These are significant sites or structures that have been designated as landmarks due to their historical or cultural importance. Investing in these properties can be a way to contribute to the preservation of our shared history.

Understanding the benefits of investing in historic properties.

Investing in historic properties can offer a range of benefits, both financial and personal. Some of the key benefits of investing in historic properties include:

-

Potential for higher appreciation: Historic properties often have a unique charm and character that can attract buyers willing to pay a premium. This can result in higher property values and potential for greater appreciation over time.

-

Tax incentives: Many governments offer tax incentives, grants, or other financial incentives to encourage the preservation of historic properties. These incentives can help offset the costs of renovation or maintenance.

-

Sense of pride and ownership: Owning a piece of history can provide a sense of pride and ownership that may not be present with newer properties. Investing in historic properties allows you to contribute to the preservation of our cultural heritage.

Steps to take before investing in historic properties.

Before diving into investing in historic properties, there are some important steps to take to ensure a successful investment. Here are some key steps to consider:

-

Research local regulations: Historic properties are often subject to specific zoning regulations, building codes, and preservation requirements. It is important to research these regulations before investing to ensure you are aware of any restrictions or requirements.

-

Conduct a thorough inspection: Historic properties may have unique maintenance issues or structural concerns that need to be addressed. It is essential to conduct a thorough inspection of the property to identify any potential issues and estimate renovation costs.

-

Evaluate the market: Just like any other real estate investment, it is important to evaluate the market trends and demand for historic properties in the area. Understanding the market dynamics can help you make informed investment decisions.

Investing in historic properties: Tips for success.

Once you have completed your research and due diligence, it’s time to start investing in historic properties. Here are some tips to help you succeed in your historic property investments:

Location is key.

When investing in historic properties, location is key. Consider properties in desirable neighborhoods or areas with a rich history and cultural significance. Properties located in historic districts or near popular landmarks tend to attract more buyers and can offer higher appreciation potential.

Work with professionals.

Investing in historic properties can present unique challenges, so it’s important to work with professionals who are experienced in historic preservation and restoration. Consider hiring a real estate agent, architect, contractor, or preservation specialist who can provide valuable expertise throughout the investment process.

Plan for renovations and maintenance.

Historic properties often require specialized renovations and maintenance to maintain their historical integrity. It’s essential to budget for these costs and plan for any necessary repairs or upgrades. Consider working with contractors or preservation experts who have experience working with historic properties.

Understand the preservation requirements.

Before investing in a historic property, make sure you understand the preservation requirements and restrictions that apply to the property. This may include obtaining permits for renovations, complying with zoning regulations, or adhering to specific design standards. Failure to comply with these requirements can result in fines or penalties.

Consider long-term investment goals.

When investing in historic properties, it’s important to consider your long-term investment goals. Are you looking to renovate and flip the property for a quick profit, or hold onto it for rental income? Understanding your investment goals can help you make informed decisions throughout the investment process.

Financing options for investing in historic properties.

Financing an investment in historic properties can be challenging, as traditional lenders may be hesitant to finance properties with unique preservation requirements. Here are some financing options to consider when investing in historic properties:

Preservation loans.

Some financial institutions offer preservation loans specifically designed for historic properties. These loans may offer favorable terms, lower interest rates, or longer repayment periods to help investors finance renovation costs.

Historic tax credits.

Historic tax credits are federal or state incentives that provide tax breaks to owners of historic properties who undertake preservation projects. These tax credits can help offset renovation costs and make investing in historic properties more financially feasible.

Partnership or crowdfunding.

Consider partnering with other investors or using crowdfunding platforms to raise capital for your historic property investment. By pooling resources with other investors, you can spread out the financial risk and access additional funding for renovation or maintenance costs.

Private lenders or hard money loans.

If traditional lenders are unwilling to finance your historic property investment, consider working with private lenders or seeking hard money loans. These alternative financing options may offer more flexibility and higher approval rates for historic property investments.

Conclusion: Investing in historic properties can be a rewarding and unique investment opportunity for those looking to preserve our cultural heritage while generating financial returns. By following these tips and steps, you can successfully navigate the process of investing in historic properties and contribute to the preservation of our shared history. Remember to conduct thorough research, work with experienced professionals, and plan for renovations and maintenance to ensure a successful historic property investment. Happy investing!