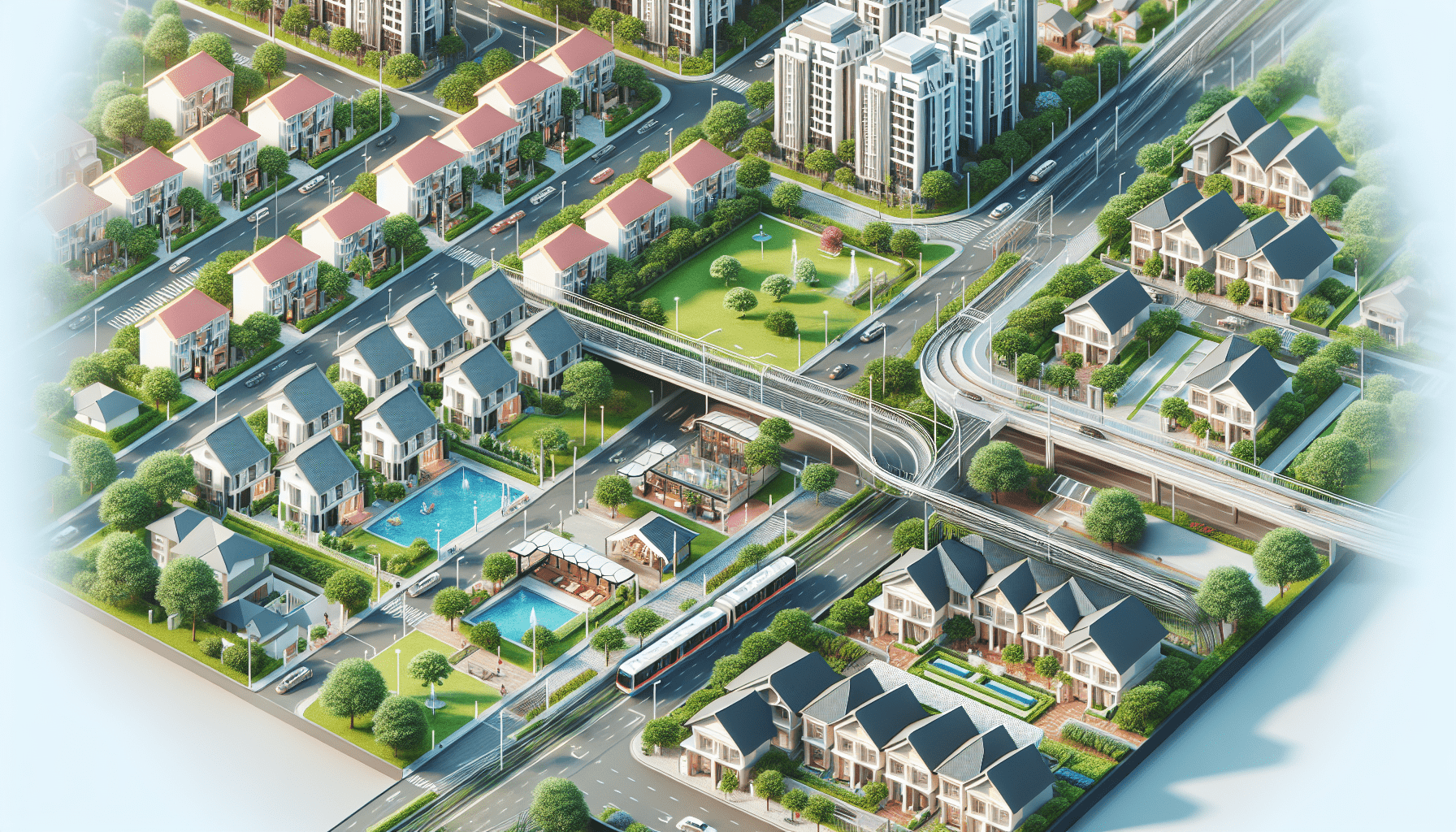

Welcome! In this article, you will learn valuable tips on how to assess the potential for property value appreciation. By understanding key factors such as location, market trends, and property features, you can make informed decisions to maximize your investment. Whether you are a first-time homebuyer or a seasoned investor, these insights will help you evaluate the growth potential of your property and make sound financial choices. Let’s dive in and discover how to assess the potential for property value appreciation! How To Assess The Potential For Property Value Appreciation?

Are you looking to invest in real estate but unsure of how to assess the potential for property value appreciation? This article will guide you through the process and help you make informed decisions. By understanding the factors that influence property value, you can identify properties with the potential for long-term appreciation.

Factors Influencing Property Value

When assessing the potential for property value appreciation, it’s essential to consider the various factors that can influence the value of a property. These factors can vary depending on the location, market conditions, and other external variables. By understanding these factors, you can make more informed decisions when investing in real estate.

Location

One of the most critical factors influencing property value is the location of the property. Properties located in desirable neighborhoods with good school districts, low crime rates, and easy access to amenities such as shopping centers, restaurants, and parks tend to have higher property values. On the other hand, properties in less desirable areas may have lower property values.

When assessing the potential for property value appreciation, consider the location of the property and its proximity to key amenities. Properties located in up-and-coming neighborhoods or areas experiencing gentrification may have greater potential for appreciation over time.

Market Trends

Another essential factor to consider when assessing property value appreciation is market trends. Real estate markets are constantly changing, and understanding current market trends can help you predict future property value appreciation. Factors such as supply and demand, interest rates, and economic conditions can all impact property values.

Researching market trends in the area where you’re considering investing can help you gauge the potential for property value appreciation. Look at historical data, recent sales prices, and forecasts for the real estate market to get a better understanding of where property values are headed.

Property Condition

The condition of a property can also influence its potential for value appreciation. Well-maintained properties with updated features and amenities tend to have higher property values than properties in need of repairs or renovations. Investing in properties that are in good condition can increase the likelihood of value appreciation over time.

When assessing the potential for property value appreciation, consider the condition of the property and any potential repairs or renovations that may be needed. Factor in the cost of improvements when calculating potential appreciation to ensure that you’re making a sound investment.

Methods for Assessing Property Value Appreciation

Now that you understand the factors that can influence property value, let’s explore some methods for assessing the potential for property value appreciation. These methods can help you evaluate potential investment opportunities and make informed decisions when purchasing real estate.

Comparative Market Analysis (CMA)

One common method for assessing property value appreciation is a comparative market analysis (CMA). A CMA involves comparing the property you’re interested in to similar properties in the area that have recently sold. By looking at comparable properties and their sales prices, you can estimate the potential value of the property you’re considering.

To conduct a CMA, work with a real estate agent or use online tools to compare recent sales prices of similar properties in the area. Look at key factors such as square footage, number of bedrooms and bathrooms, and amenities to get an accurate estimate of the property’s value.

Cash Flow Analysis

Another method for assessing property value appreciation is a cash flow analysis. A cash flow analysis involves estimating the potential income and expenses associated with owning the property, including rental income, maintenance costs, and property taxes. By calculating the potential cash flow of a property, you can determine its value appreciation over time.

To conduct a cash flow analysis, estimate the rental income the property could generate based on the current market rates. Deduct operating expenses such as maintenance, property taxes, insurance, and vacancy rates to calculate the property’s potential cash flow. Compare this cash flow to the property’s purchase price to assess its potential value appreciation.

Capitalization Rate (Cap Rate)

The capitalization rate, or cap rate, is another method for assessing property value appreciation. The cap rate is calculated by dividing the property’s net operating income by its purchase price. A higher cap rate indicates a higher potential for value appreciation, as it represents a higher return on investment.

To calculate the cap rate, estimate the property’s net operating income by subtracting operating expenses from the rental income. Divide this net operating income by the property’s purchase price to determine the cap rate. Compare the cap rates of different properties to assess their potential for value appreciation.

Strategies for Maximizing Property Value Appreciation

In addition to assessing the potential for property value appreciation, it’s essential to consider strategies for maximizing value appreciation over time. By implementing these strategies, you can increase the value of your investment property and generate higher returns.

Renovations and Improvements

One strategy for maximizing property value appreciation is to invest in renovations and improvements. Upgrading features such as kitchens, bathrooms, flooring, and appliances can increase the value of a property and attract higher rental rates or sales prices. By investing in strategic renovations, you can enhance the appeal of your property and maximize value appreciation.

When considering renovations and improvements, focus on upgrades that offer the highest return on investment. Consider factors such as the cost of improvements, potential rental income or sales price increases, and market demand for upgraded features. By investing in renovations that add value to the property, you can increase its potential for appreciation.

Property Management

Effective property management is another key strategy for maximizing property value appreciation. By keeping your property well-maintained, addressing tenant needs promptly, and staying informed about market trends, you can enhance the value of your investment property over time. Effective property management can help you attract and retain quality tenants, reduce vacancy rates, and increase rental income, leading to higher property values.

When managing your investment property, prioritize regular maintenance, prompt communication with tenants, and staying informed about market conditions. Consider hiring a professional property management company to handle day-to-day operations and ensure that your property is well-maintained. By implementing effective property management strategies, you can maximize property value appreciation and generate higher returns on your investment.

Diversification

Diversifying your real estate portfolio is another strategy for maximizing property value appreciation. By investing in properties in different markets or asset classes, you can spread risk and take advantage of opportunities for growth in multiple areas. Diversification can help you minimize the impact of market fluctuations and maximize value appreciation across your real estate investments.

When diversifying your real estate portfolio, consider investing in properties in different locations, asset classes, and investment strategies. Research emerging markets, explore new asset classes such as multifamily or commercial properties, and consider different investment structures such as partnerships or real estate investment trusts (REITs). By diversifying your real estate portfolio, you can mitigate risk and maximize potential for property value appreciation.

Conclusion

Assessing the potential for property value appreciation is essential when investing in real estate. By understanding the factors that influence property value, using methods to assess value appreciation, and implementing strategies to maximize value appreciation, you can make informed investment decisions and generate higher returns on your real estate investments. Whether you’re a seasoned investor or a first-time buyer, following these tips can help you identify properties with the potential for long-term appreciation and make sound investment decisions in the real estate market.